BLUE EYED

PRIVATE DEBT FUND I

BLUE EYED

PRIVATE DEBT FUND I

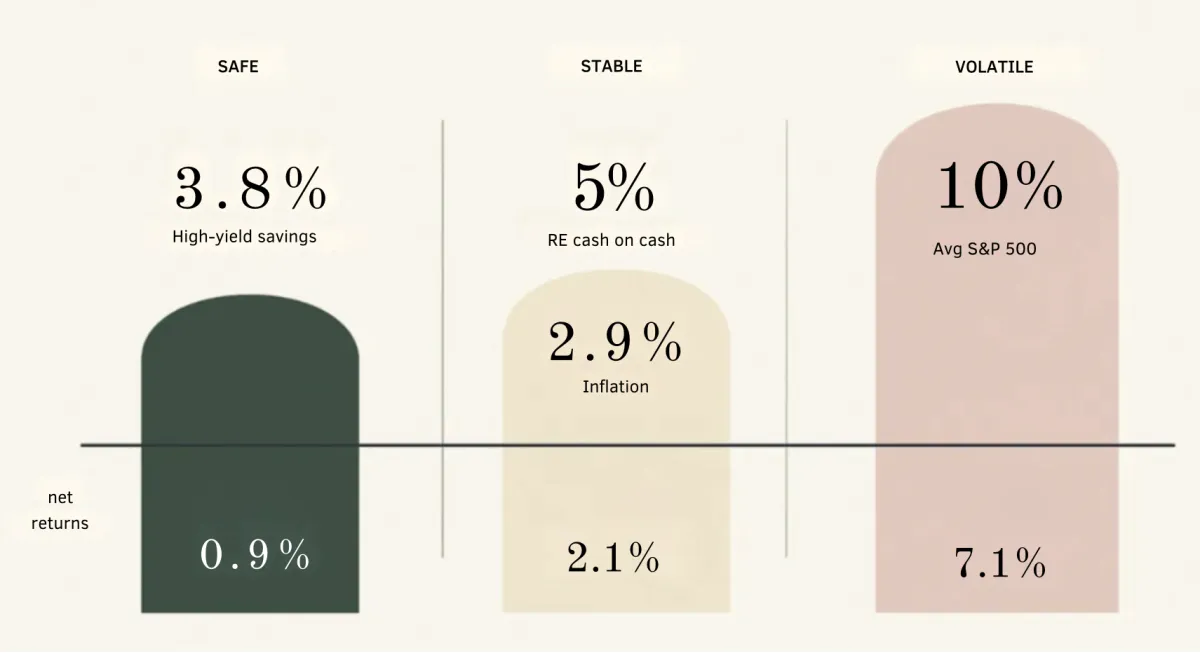

Are Your Returns Keeping Up?

Today, traditional yields are falling short. Inflation is eroding savings and market volatility forces longer hold times for tangible gains to materialize.

Today, traditional yields are falling short. Inflation is eroding savings and market volatility forces longer hold times for tangible gains to materialize.

Private Debt Offers a Smarter Alternative

Fixed Strategy

Fix & Flips, Land Flips, Earnest Money Deposits and Gap Lending

Short Term loans < 6 months

Collateralized, verified borrowers

Investor Focused

Sponsor invested alongside you

Low cost of entry at $15,000

50/50 profit share above pref

Quarterly distributions

Transparent Operations

Dedicated loan tracker so you can see where your money is.

Quarterly reporting

Quarterly investor Q & A calls

Private Debt Fund I

Why Blue Eyed Capital?

Transparent reporting

Institutional grade operations

Proven track record across market cycles

Decades of high pressure, high result work

Low minimums, below average fees

GP Capital invested alongside you

Past Performance

Loan Case Study

Student Housing EMD

How We Mitigate Risk

Your Path to Predictable Income

01

02

03

Visit the Deal Room and Meet the Team

Submit Commitment and Get Qualified

Finalize Funding and Initiate Investment

NOTICE: An investment in commercial real estate is speculative and subject to risk, including, inter alia, the risk that all of your investment may be lost. Any representations herein concerning the viability and profitability of investing in commercial real estate, including, without limitation, the stability, diversification, security, resistance to inflation and any other representations as to the merits of investing in commercial real estate reflect our belief concerning the representations and may or may not come to be realized. Cash distributions and any specific returns are not guaranteed. Securities are only available to verified accredited investors who can bear the risk of loss of their investment.

The information contained herein, including text, graphics, images and information, is general in nature and is for informational and illustration purposes only.

Blue Eyed Capital makes no representations or warranties of any nature whatsoever regarding any tax matters, including, without limitation, the ability of an investor to invest in Blue Eyed Capital with its specific self-directed IRA vehicle. The investor should independently obtain advice from his or her own independent legal counsel and/or tax accountant and/or IRA servicer regarding any such investment and the tax benefits and burdens associated with same.